Lead generation for insurance agents has changed forever...

You might have noticed that what used to work a few years ago doesn’t work as well today.

Do any of these sound familiar:

- Your carefully scripted cold calls go unanswered.

- Your thoughtfully executed direct mail campaigns go straight into the recycle bin.

- Your polished presentations are tuned out.

And please don't even talk about door-to-door sales.

But no need to panic. There are plenty of potential prospects - more than ever, in fact. They just aren't doing what they used to do.

Internet use is now fully ingrained in the buying process of almost all consumers.

Yes, this extends to insurance. Your potential customers are online researching policies, looking for rates, and finding agents. With your customers looking for insurance online, all you need to do is meet them there and you have a source of endless leads.

The fastest way to get in front of all of those online consumers looking for insurance is through Pay Per Click (PPC) advertising. People need the types of policies you’re offering and your expertise. PPC advertising simply puts you in front of them at exactly the right time: when they are already looking for you.

Sounds simple, right? Unfortunately, it’s not.

Don't worry. We're here to show you everything you need to know to get started with pay-per-click.

While the concept is simple - you pay for clicks - the details can quickly get very complicated. The pay per click landscape is complex and the learning curve is steep. Because of this there’s a very fine line between a campaign that produces a steady flow of leads and one that burns a hole in your wallet.

Many agents have dipped their toes into the pay-per-click waters only to quickly find out the water’s too hot for them. But, it doesn’t have to be that way - armed with a little knowledge, there is success to be had for insurance agents in pay per click.

We put this guide together to help you successfully navigate the pay-per-click maze so that your PPC campaigns don’t burn a hole in your wallet!

## Learn everything an insurance agent needs to know about getting leads through pay-per-click

This guide has you covered.

CHAPTERS:

- Part I. Why Incorporate Paid Advertising into Your Insurance Marketing Strategy?

- Part II. The #1 Mistake Insurance Agents Make in PPC Advertising

- Part III. Bidding on Keywords

- Part IV. Match Types

- Part V. Quality Counts

- Part VI. Auction Process

- Part VII. Types of Paid Ads

- Part VIII. Ad Networks

- Part IX. Tracking

- Part X. Using Landing Pages in Your Campaigns

- Part XI. Structuring Your Insurance PPC Campaigns

- Part XII. Optimizing Your Campaigns for the Best Results

- Part XIII. Making It Work for You

Part I. Why Incorporate Paid Advertising into Your Insurance Marketing Strategy?

Before we talk about pay-per-click advertising, let's talk for a second about the other big online marketing stragey - search engine optimization (or "SEO").

Insurance marketers the world over preach the potency of organic lead generation - this is generating leads through search optimization.

For years, this has been the golden strategy for insurance lead generation.

I know, it's the dream.

You make a few changes to your site, get it ranked for a keyword, and the leads roll in while you drink a mai tai on the beach. Yes, that's just a dream.

But here's the reality:

While organic search can be a highly effective way to generate insurance leads, it only works for a small number of agents. And it has its limits.

You have to be on page one of the search engines for the right phrases to be seen. Getting there is a gradual, labor-intensive process. Add all the other well-established competitor insurance agencies, carriers, and online brokers to the mix, and the race to the top gets even tougher. 10 spots on the first page of Google and thousands of agents battling it out for them.

It gets worse.

Even if you do all of the hard work and claw your way to the top, there's a decent chance you'll still get buried.

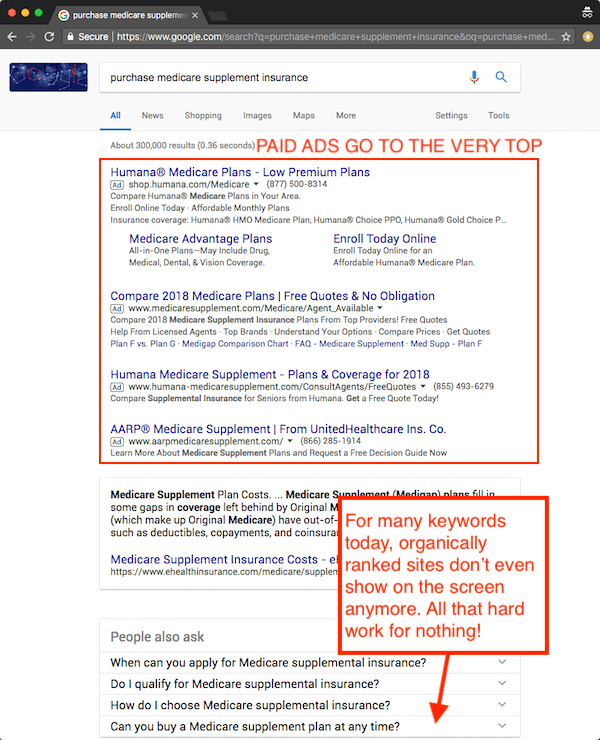

Take a look at this real life search engine results page:

Google makes their money off of pay-per-click advertising. And as you can see from the above image, they are reserving the best real estate for paying customers.

Pay-per-click offers several benefits to a lead-hungry agent

Gain Control: With organic lead generation, the search engines decide who sees your insurance websites based on a variety of factors. If you don’t meet all their relevancy criteria for a given search, you’ll miss out on potential paying clients. Paid ads give you the freedom to decide which searches bring up your ads. Since you’re paying to be seen and in control of where and when, you’re automatically relevant when those insurance-based searches come across.

Get More Leads: Paid advertising gives you an opportunity to not only reach more people courtesy of guaranteed page-one visibility, but appear to highly targeted groups of potential insurance buyers. In other words, you know that you’ll show up when a prospect is looking for what you have to offer. More to the point, you’ll be seen by a wide range of prospects who are looking for coverage and ready to be drawn further into your sales funnel.

Works Quickly: Getting to page via organic search optimization takes months (or years), if at all. Paid ads are the key to instant first-page visibility. They help make sure the right people notice you right away without months and months of work to get ranked by the search engines.

These are all great things.

While organic search takes tremendous time and effort (not to mention the “rules” are constantly evolving), pay per click begins producing results almost instantly. They give you more control over who sees your agency online; not to mention, they guarantee you a spot on page one of your strategically selected search results.

Part II. The #1 Mistake Insurance Agents Make in PPC Advertising

Keywords are king throughout the online world, and paid advertising is no exception.

After all, you want your ads to show up when prospects search for the insurance coverage you offer. This means you need to focus on keywords most often used during searches pertaining to:

-- Your agency

-- Your target market

-- The problem your prospects need solved

-- The insurance products you offer

Then you build paid ads around those keywords. Simple enough.

Here's where most agents go wrong.

Most agents getting started with pay per click advertising set themselves up for failure at step 1 of creating their campaign. How? By trying to tackle the big, obvious keywords directly. It's so tempting to go after product names like "life insurance", "medicare supplement", or "long term care insurance".

Sure, people searching for those phrases might be looking for those products. But they might be looking for a job selling the product, or to file a claim on the product, or even to issue a consumer complaint.

The "big" phrases with lots of traffic are too generic. That means most of your money is going to go to clicks that aren't by people looking for what you are selling. Wasted clicks = wasted money.

You don't want that.

Instead, think about the phrases buyers will be typing into a search engine that indicate they are in shopping mode.

Move beyond simply targeting a product name, such as “life insurance”. Somebody typing that into a search engine isn’t necessarily looking to buy it. Go a level deeper:

- “life insurance rates”

- “how much does life insurance cost?”

- “how do I buy life insurance”

- “life insurance agent.”

These are all phrases that are related to the process of buying insurance.

Make sense?

As a general rule, the more targeted your keywords are, the better.

While it’s tempting to bid for the “big” traffic phrases (think “medicare supplement”, “life insurance”, etc) to get lots of traffic, resist the urge.

Instead, try to create lots of small groups of closely related and very targeted phrases. This allows you to ensure the keywords, ads, and landing pages are all relevant to each other. And because you’re adding traffic in a very focused way, you will know exactly what works without spending lots on the things that don’t work.

Since ads are categorized by topic, it’s important to create a list of keywords that are relevant to your industry and specific agency. Group similar words together before writing your ads. This way, you can cover more than one key phrase at a time and cover more ground with a single ad.

Ultimately, your ad will appear on search results and websites pertaining to those chosen keyword phrases. You’ll pay an agreed upon amount each time someone clicks on your ad. Keep in mind, those clicking on your ads are already looking for insurance coverage, so they’re most likely pre-qualified leads. At the same time, you can speak to people in varying stages of your sales funnel, propelling them closer to conversion.

Got it? Let's keep going.

Part III. Bidding on Keywords

Once you’ve chosen the keywords you’d like to focus on, you’ll need to bid on them to secure your ad’s place on those highly coveted advertising venues. There are several bidding options at your disposal. Which one is best for your agency depends on the type of campaign you’ll be launching and its overall goals.

So here we go.

Clicks: When you want people to click on your ad and be whisked to your website, basic cost-per-click bidding would be the way to go. Someone clicks — you pay. Someone doesn’t click — you don’t pay.

Impressions: If the goal for an ad is simple exposure, or if you have a very targeted ad that gets lots of clicks, focusing on impressions may be a better option. With this route, you’ll pay a set amount for every 1,000 times your ad appears before internet-wandering eyes.

Conversions: On the more advanced side of the paid advertising realm, you have cost-per-conversion bidding. Here, you’re bidding for optimal spots to boost your conversion rate. You pay each time someone acts on the call to action on a given ad. Think about how much you might pay for an exclusive lead and you’ll have a sense of what a conversion might cost.

Views: If video ads are going to be part of your advertising campaign, this type of bidding would apply. You pay for views and clicks on accompanying calls to action.

So what's the magic formula?

In short, decide which keywords to focus your ads on, and build from there. Determine which types of ads your paid campaign will include, and lay out your bidding strategy accordingly. Keep in mind, placing the highest bid for a particular keyword group isn’t necessarily what wins your spot. We’ll discuss this in greater detail later.

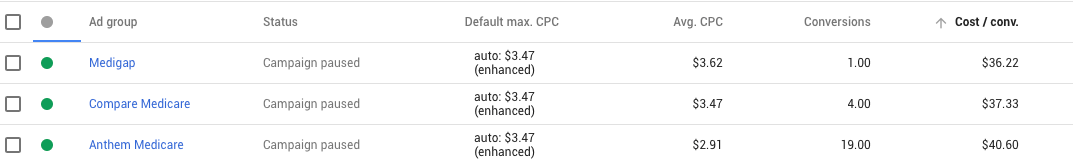

Part IV. Match Types

In addition to numerous bidding choices, you also have several types of keyword matches to choose from when developing your bidding strategy. These allow for greater control over which searches trigger your ads and can help maximize effectiveness while minimizing unnecessary cost.

Broad Match: With this option, your ad could show up in search queries even remotely matching your chosen keyword phrase. If the ad focuses on whole life insurance, it could appear in search results for whole life, term life, motorcycle insurance… or whole cashews. Though your ads will reach more people with this type of match, your conversion rate might not be quite as high because there’s a higher risk of your ad showing to people that aren’t looking for what you are offering.

Modified Broad Match: Should you choose modified broad match, your relevancy parameters will be narrowed down a bit more. Using the example above, an ad for whole life insurance would only appear in searches for whole life, life insurance and other closer matches. You still get higher visibility, but it’s geared a bit more toward people who are ready to come to you for coverage.

Phrase Match: Still more restrictive, choosing phrase match will ensure ads only appear when the exact target phrase is used in a search query; however, this option does allow for a little wiggle room. Sticking with the previous instance, your whole life insurance ad might show up when someone searches for affordable whole life insurance, cheap whole life insurance coverage or whole life insurance policies. It’s still not perfect - your ad would show up for people looking to “cancel whole life insurance”, “file whole life insurance claim”, or “sell whole life insurance”.

Exact Match: As you might imagine, selecting exact match makes sure your ad only appears in searches using your exact keyword phrase. Although this alternative will generate less visibility, it’ll most likely lead to a higher conversion rate because those seeing this ad are sure to be interested in whole life insurance.

Match type affects the amount of exposure an ad gets, how much it’ll cost to ensure it pops up during users’ searches and overall effectiveness among other factors. Far-reaching visibility doesn’t necessarily trump greater conversion likelihood, but it might in some cases. Diversifying your approach may very well be the best course of action here.

Tip: Getting the match type right really helps you compete with national advertisers such as online brokers and carriers. Because they are trying to cover as much ground as possible, they often get sloppy on match type. You can slip in, get the match type dialed, and dramatically increase your quality score (we’ll get into that next), which in turn will give your ads a big boost at a lower cost.

Part V. Quality Counts

In the world of insurance coverage, quality counts in so many ways. Coverage options and customer service help build longstanding relationships with policy holders. At the same time, they generate the all-powerful word-of-mouth advertising your agency needs to keep new clients coming in at a steady pace.

When it comes to paid ads, quality will go a long way toward enticing target audience members to dig deeper into your offerings. Of course, it doesn’t end there. Search engines tabulate a quality score for your ads and this figure determines if and where you’ll appear in searches. It also plays a role in how much you’ll pay to have your ads displayed.

High-quality paid ads boost your bottom line from both ends of the advertising spectrum. They create greater consumer interest while keeping your advertising costs as low as possible. Quite a bit of middle ground falls in between, and it can work to your agency’s advantage.

Part VI. Auction Process

Paid ads and their associated bids are submitted to the advertising network, such as Google’s Adwords network. Whenever a user performs a search pertaining to your chosen keywords, Google automatically does a split-second auction during which your ads and bids are weighed against those of the competition. Through process of elimination, the search engine giant weeds out any ineligible options.

From there, Google compares ads’ bids and quality scores to further determine whether or not they’ll be displayed in search results and which position they’ll get if they make the cut. All this takes place in the amount of time needed to generate a list of search results.

This is where quality score becomes really important. Because quality score indicates how likely it is for an ad to get clicked on, ads with higher quality scores get a boost. Think of it this way - if ad A is 3 times more likely to get clicked on than ad B, a $1 bid for ad A is about the same as a $3 bid for ad B. That’s a big deal.

Part VII. Types of Paid Ads

Along with various matches and bidding options, you have a couple of basic types of ads to choose from: text and display ads. As the name indicates, text ads come in wholly written form. Much like your agency’s organic search results, they consist of a keyword-bearing headline, display URL and a brief description of what you’re offering prospects. Hopefully, they also contain a call to action.

Display ads take things up a notch, containing images or video as well as text. They can be emblazoned on websites with advertising space for sale and generate interest in your agency in a wide range of clearly visible locales. Both native and traditional display ads are at your disposal. Though the former is considered a bit less intrusive, the latter really stands out in a sea of surrounding content.

Part VIII. Ad Networks

Paid online ads don’t place themselves, but plenty of ad networks are out there to act as middlemen in this regard. Not all of them are right for all companies. Different targeting options available through each can give you a leg up on the competition, but they can also work against you.

Google Adwords is the most popular network for businesses hoping to get their names out there, perhaps because it’s the most popular search engine among consumers. With more than three billion searches performed each day on Google, paid advertising efforts through this channel are bound to be seen.

Bing and Yahoo also offer their own search advertising options. All three major search engines give insurance agencies a wide range of targeting alternatives. They allow you to reach consumers based on several factors, such as keywords and typical search patterns.

Social advertising brings yet another outlet to the table. With this type of platform, you can spread the word about your agency according to interests, age, gender and a long list of other demographics. Facebook is the most highly sought-after of these at more than a billion users ranging from their early 20s to their mid-50s for the most part.

Twitter comes in at second place with an estimated 600 million users from the younger generation. Instagram follows with 200 million current clients and potential policy holders in their late teens through late 20s. As a business-focused site, LinkedIn is geared more toward professionals and entrepreneurs. Here, you can cater to B2B and B2C coverage needs based on career, industry and other similar elements.

Reaching action-ready prospects is a virtual guarantee through these channels. They also help raise awareness about policies and insurance products the public may not be actively searching for at the moment. Still, they’re sure to need coverage at some point. When that time comes, they’ll already have you in mind.

Part IX. Tracking

Trackability is a key benefits of paid advertising. Once you determine which keywords you’ll be concentrating on, create ads to match and set up your accounts to start bidding on prime online advertising real estate, you’ll be able to keep up with how effective your efforts are. Due to the diverse nature of paid advertising, this is a fairly complicated field.

First off, you’ll need to decide just what you want to track. Are you interested only in leads who are transformed into paying customers? Do you want to know which prospects follow your calls-to-action for free quotes? Although the baseline figures and variables are different for each, a few aspects reign supreme.

Cost per Click: When determining the cost-effectiveness of your paid advertising efforts, you’ll need to understand the cost per click. To figure this, divide the amount you’re paying by the number of clicks an ad receives.

Click through Ratio: Click through ratio tells you how effective an ad is based on the number of clicks it gains divided by how many times it was displayed.

Conversion Rate: Conversion rate, which is the number of prospects-turned-paid-customers divided by the number of clicks on a specific ad.

Cost per Lead: In order to tabulate your cost per lead, add up your total marketing expenses for paid ads. Then, count the number of leads generated via those ads. Divide the former by the latter, and you’ll have your CPL.

With these basic formulas, you can track the effectiveness of your ad campaigns as well as their costs. What you consider converts may be different than those of another agency, but these can be calculated based on your advertising goals. Make them your own, and use them to your advantage.

Part X. Using Landing Pages in Your Campaigns

Regardless of keyword focus, ad group, match type and other factors, those paid efforts aren’t the end of your journey. What do you want people to do after they see your ads? Sure, one goal is to draw them to your website, but it contains more than one element, right?

What we’re getting at here is landing pages, or the pages those ads lead to once they’re clicked. An effective landing page can keep prospects on your website and entice them to dive further into the sales funnel. Kissmetrics sums it up best with their CONVERTS landing page model.

C - Clear Call to Action: Don’t stray from what you want visitors to do once they reach your landing page. Fill each landing page with information relevant to the overall gist of the ad that takes prospects to it, all ultimately leading to a single, definitive call to action.

O - Offer: Be sure to emphasize the offer corresponding to your call to action, and try giving visitors a limited time frame in which to take advantage of it. This tends to encourage cooperation.

N - Narrow Focus: Simplicity is the key to success when dealing with the public. Concentrate on relevancy, and center efforts on the task at hand.

V - Very Important Attributes: Include a few key details about why visitors should choose your agency and the product emphasized on the landing page over competitors’ offers without overwhelming them with unnecessary info.

E - Effective Headline: Clarity and simplicity continue to rule here. Make sure the landing page headline gives viewers a clear idea of what they can expect to find below.

R - Responsive Layout: Not everyone will be coming to your landing page via the same device you’re viewing it on, so it may look very different to some of your prospects. Be sure all the most important elements appear at the top center of the screen and the layout is compatible across the board.

T - Tidy Visuals: Make sure landing pages are optimized for the human experience. Content should be broken up into easily readable chunks with clearly visible headings and subheadings. Don’t toss in several unnecessary pictures or animations just to fill space; they’ll detract from your overall message.

S - Social Proof: Word-of-mouth continues to be a huge influence on the public, so try to add in a few customer quotes, numbers of satisfied policy holders or other forms of proof that you’ve built a satisfied following.

Overall, you want to get prospects to take a specific action. An ad’s landing page should ultimately focus on that task, but it needs a few extras to usher visitors toward the prize. Find a nice balance between conciseness and enticement without being overly bland or making the page too busy.

Part XI. Structuring Your Insurance PPC Campaigns

When creating your insurance pay per click campaigns, you’ll want to structure them to position you for success. This means you don’t just pick a big list of keywords, write a few ads, and send them to a landing page. You want to organize them so the data you get helps you optimize the campaigns and group them so the keywords, ads, and landing pages are all relevant. Here’s how to structure your campaigns:

Campaign - Focus your campaign on the type of ads you want to run, the target market and product, and your budget. For example, if you market life insurance, you’ll want to create separate campaigns for “term life insurance” and “final expense insurance” even if you are using the same ad network for both.

Ad Group - Within your campaign, you’ll create ad groups based on the specific search intent you are searching for. For example, someone looking for “best term life” has a different intent than someone looking for “cheapest term life”. The result is the same, but the first is focusing on quality and the second is focusing on cost.

Keywords - Now that you have your ad groups, you will want to add 5-10 keywords to each one. This allows you to keep everything relevant, using similar words in the keywords, ads, and landing pages. Google suggests no more than 30 keywords per ad, but in our experience you are better off going with even few. Our advice is if you find that you have more than 10 keywords in an ad group, break it down into more groups.

Ads - For each ad group, write 2-3 ads. Really focus on the words that make that ad group distinct from the others and speak to that offer. Over time you’ll test and refine your ads so try to create ads that are different from each other.

Part XII. Optimizing Your Campaigns for the Best Results

Everything we’ve talked about so far is the mechanics of pay per click advertising. This will help you make sense of setting up a campaign, but to really get the results you need you will have to do lots of optimization. The concept is fairly simple: all of the data you’ll gather running your campaigns will allow you to see what’s working and what isn’t.

Optimize your keywords and ad groups

Once you have some data in your campaign, go through and see what’s producing results and at what cost. You will begin to see patterns - some keywords and ad groups consistently produce lower results at a higher cost than others. Cut those keywords.

For the keywords that are producing the best results, consider pulling them out and creating their own ad groups. This will help you do two things. First is you can expand the keyword into lots of related variations. And second, you can take a deep dive in testing ads against that keyword.

By cutting the keywords, ads, and ad groups that are not working and refining those that are, you can quickly and dramatically improve your results. Then you can consistently test new ads against your best performers to find new ways to improve results.

Add negative keywords

Out of the gate, you’re wasting a tremendous amount of money on clicks that have no intention of buying the insurance you’re selling. For example, your advertising running for “best term life insurance” may show for someone searching for “best term life insurance commissions”. This is another agent (your competition!) and when they see their ad, they click to see what you are up to.

The way you stop this is by adding negative keywords. You set these up in your campaign with explicit instructions NOT to show your add if they are included in a search phrase. There are some obvious ones, such as “careers”, “jobs”, “complaints”, and “claims”. But there are also lots of not-so-obvious ones, such as “best term life insurance website builder” (that’s us!).

Fortunately, there’s a way to find out what searches are driving the wrong clicks and costing you money. You do this by looking for the “search terms” report in your ad platform. In Google Adwords, select your campaign, click on “Keywords”, and then select “Search Terms”. You can quickly select the bad terms here and ad them as negatives to the campaign.

Part XIII. Making It Work for You

Paid advertising shouldn’t be your agency’s only source of traffic, but it shouldn’t be left out of the mix, either. At the same time, all your efforts can’t be filtered into a single type of ad or bidding method. Start small, working your way up from there.

Consider giving various ad types trial runs to see which ones your target audience responds to best. Build on the most effective alternatives. Keep in mind, although you may not be able to beat out certain competitors in the budget department, focus and quality could very well be your saving grace.

This isn’t a set-it-and-forget-it matter any more so than your SEO efforts. You’ll need to continually update ads and create new offers to remain in line with consumers’ mindsets. Ongoing diligence and attention to detail will pay off in the long run.